When it comes to managing finances, understanding the components of your mortgage payment is crucial. Each month, homeowners receive a bill that encompasses various elements, including principal, interest, taxes, and insurance. Among these, the monthly principal and interest payment is a significant figure that requires scrutiny—especially if it amounts to $3,078.59. A question arises: what does this payment represent in the larger context of your mortgage? This article aims to dissect the total implications of this monthly payment and provide insights into mortgage payments in general.

For many, the idea of a mortgage is daunting, filled with technical jargon and complex calculations. However, breaking down your monthly principal and interest payment can simplify this concept. Understanding how much you owe each month and what factors influence this payment can empower you as a homeowner. In this article, we will explore various aspects of mortgage payments and reveal the total amount owed when your monthly principal and interest payment is $3,078.59.

Moreover, we'll address common questions surrounding mortgage payments, guiding you through the maze of interest rates, loan terms, and financial commitments. The goal is to aid you in navigating your financial landscape with confidence and clarity. So, let’s delve deeper into the world of mortgage payments and uncover the total associated with a monthly principal and interest payment of $3,078.59.

What Factors Determine My Monthly Principal and Interest Payment?

Several key factors influence the monthly principal and interest payment on a mortgage. Understanding these components can provide clarity on how your payment is calculated:

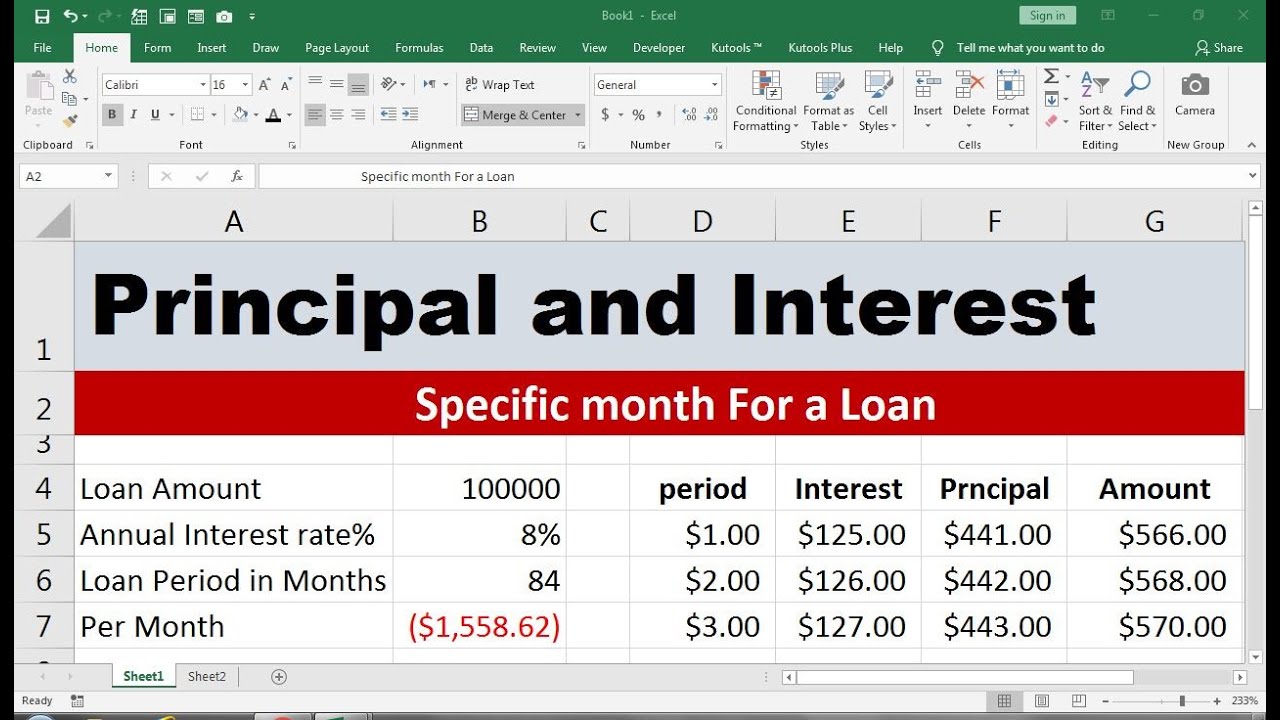

- Loan Amount: The total amount borrowed plays a significant role in determining your monthly payment.

- Interest Rate: The rate at which interest accrues on your loan directly affects the payment amount.

- Loan Term: The length of time you have to repay the loan can also impact your monthly payment.

- Amortization Schedule: This schedule outlines how your loan balance decreases over time.

How Is the Total Amount Calculated?

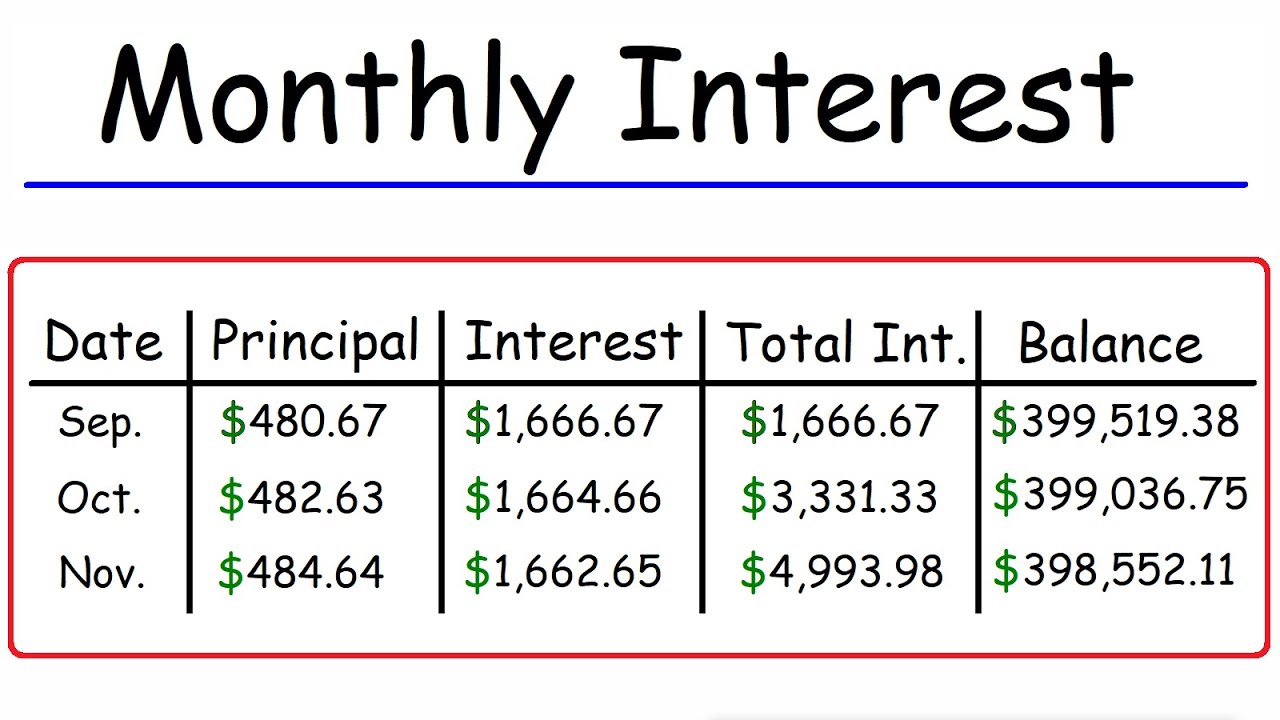

Calculating the total amount owed on a mortgage isn't just about multiplying your monthly payment by the number of months. The total amount includes the principal, interest, and any additional fees that may arise. Here’s a simplified breakdown of how to compute the total:

- Identify your monthly payment: In this case, $3,078.59.

- Determine the loan term in months.

- Multiply the monthly payment by the number of months to get the gross total.

- Consider any additional costs, such as closing fees or insurance.

What Is the Total Amount Owed for a $3,078.59 Monthly Payment?

To find the total amount owed based on a monthly principal and interest payment of $3,078.59, we need to consider the loan term. For example:

- For a 30-year mortgage: $3,078.59 x 360 months = $1,109,486.40

- For a 15-year mortgage: $3,078.59 x 180 months = $554,151.20

These calculations illustrate how the total amount varies significantly based on the loan term.

Can I Reduce My Monthly Payment?

Reducing your monthly principal and interest payment is a goal for many homeowners. Here are some strategies that can help:

- Refinancing: Consider refinancing your mortgage at a lower interest rate.

- Increasing Your Down Payment: A larger down payment can decrease your loan amount.

- Extending the Loan Term: A longer repayment period can lower monthly payments, though you may pay more in interest over time.

What Should I Consider Before Refinancing?

Before deciding to refinance, consider the following:

- Closing Costs: Understand the fees associated with refinancing.

- Interest Rate: Ensure that the new rate is significantly lower than your current rate.

- Loan Terms: Consider how extending or shortening your loan term affects your total payment.

What Are Other Costs Associated with My Mortgage Payment?

In addition to the principal and interest, homeowners often encounter additional costs that can affect their overall financial picture. These include:

- Property Taxes: These taxes are typically paid monthly and can vary based on location.

- Homeowner's Insurance: Required by lenders, this insurance protects against property damage.

- Mortgage Insurance: If your down payment is less than 20%, you may need to pay mortgage insurance.

How Can I Prepare for Future Payments?

Planning for future payments is essential for financial stability. Consider the following tips:

- Create a Budget: Allocate funds each month for your mortgage payment, taxes, and insurance.

- Build an Emergency Fund: Set aside funds to cover unexpected expenses related to your home.

- Review Your Mortgage Regularly: Keep an eye on interest rates and your financial situation for potential refinancing opportunities.

What Should I Do If I Have Trouble Making Payments?

If you find yourself struggling to make your monthly principal and interest payment of $3,078.59, it’s crucial to take action:

- Contact Your Lender: Discuss your situation and explore options such as loan modification.

- Seek Financial Counseling: Professional help can assist you in managing your finances.

- Consider Selling Your Home: If payments become unmanageable, selling might be a viable option.

Conclusion: Understanding Your Mortgage Payment

In summary, your monthly principal and interest payment of $3,078.59 is a central component of your financial responsibilities as a homeowner. Understanding the total amount owed, the factors that influence this payment, and strategies for managing it effectively can empower you to make informed decisions about your mortgage. Whether you’re considering refinancing or simply looking to better understand your financial commitments, knowledge is key. By staying proactive and engaged with your mortgage, you can navigate your financial landscape with confidence.

You Might Also Like

Exploring The Fascinating World Of Taylor Swift JOIExploring The Depths Of Stoicism Rolls In Destiny 2

Unveiling The Truth: Amelie Warren OnlyFans Leaked

Brenda Lee Spencer: The Girl Behind The Infamous Tragedy

Megaphone: More Than A Rallying Cry – Insights From Pew Research Center’s Data

Article Recommendations